The start of a new school year is once again upon us and the Malakoff Housing Authority is preparing for our 2nd Annual Back-to-School Bash to help prepare our families for the ever rising cost of getting their kids back in school. Our goal this year is the same, to help ease that burden by putting together an event where parents who reside in the Malakoff Housing Authority can bring their children to get school supplies and basic hygiene items. We want our youth starting the new school year the right way, prepared and confident! In order to accomplish this we must reach out for the help of our generous community. Continue reading “Malakoff Housing Authority Back-to-School Bash”

Category: Education

Malakoff, Cross Roads Make ‘Reward Schools’ List

By Michael V. Hannigan

The U.S. Department of Education released its list of Reward Schools last weekend, and two county schools earned the top designation.

The list identifies High Performing Schools and High Progress Schools based on 2013 accountability reports.

High Performing Schools are schools that have received “distinction designations based on math and reading performance, and at the high school level, is also among the Title I schools with the highest graduation rates; or (2) has exceeded (Adequate Yearly Progress) for two or more consecutive years.”

Henderson County schools named High Performing were: Malakoff Elementary and Cross Roads Junior High. Also on the list is Martin’s Mill High School. Continue reading “Malakoff, Cross Roads Make ‘Reward Schools’ List”

Athens ISD Sets Public Hearing on Tax Rate

It is time for many local entities to start looking at their budgets for next year and that includes Athens ISD.

The Athens ISD School Board will be holding a public meeting 6 p.m. Monday, June 23, at the administration building to discuss the proposed budget and property tax rate for next year.

The proposed tax rate is $1.196470, which is one penny higher than last year.

Here are 5 things you should know about the tax rate.

1. Breakdown: The Athens ISD tax rate is broken down into two funds: Maintenance and Operations (M&O) and Interest and Sinking (I&S). Basically the I&S fund is for the school district’s debt while the M&O is for operations. Under the proposal, the M&O is 1.037380 per $100 valuation and the I&S is .159090 per $100 valuation.

2. History: Prior to this year’s proposed penny increase, the AISD tax rate has been the same for five consecutive years.

3. Increase: The penny increase in the tax rate comes in the I&S fund and will be used for the district’s debt. According to AISD Superintendent Blake Stiles, “The primary reason for the need to raise the I&S rate by one penny is because property values have not risen at the rate expected.”

4. Shortfall: The M&O rate will stay the same, however according to to the AISD documentation that will not be enough to “maintain the same level of maintenance and operations” as last year. Stiles said, “That tax rate cannot be changed without a tax ratification election, which we have no intention of conducting at this time.”

5. Challenge: How does Athens ISD get by with effectively less spending power than it had last year?

Stiles answered: “We have been working diligently to squeeze all the value we can from our operation funds. Most districts, including ours, spend around 75 percent of that portion of the budget on salaries. That means that by the time we purchase items like school buses and fuel there is very little left for discretionary spending. Facility upgrades and routine maintenance can also be a challenge when you use M&O funds to cover the costs. Luckily for us, the AISD Board of Trustees have been responsible with the taxpayers’ money and we have a healthy fund balance that we can dip into from time to time. However, the state recommends that we maintain three months worth of funding in that account in case we need it in emergency situations.”

HCRSPA Scholarship Winners

The Henderson County Retired School Personnel Association is proud to select this years scholarship winners. (TOP) They are, top row from left, Matthew Smiley of Brownsboro HS; Michael Silvey of Malakoff HS; Kaitlynn Kirkland and Jamila Murray of Athens HS. On the bottom row are their sponsors, Laurie Boze, Malakoff HS Counselor; Brandon Jones, Brownsboro HS Principal; and Thelma Griffin, Athens HS Counselor. Not shown is Mary Hamilton of Eustace HS. (BOTTOM) Along with our winners and their sponsors were some of their families to help celebrate this special occasion. Congratulations to our winners.

The Henderson County Retired School Personnel Association is proud to select this years scholarship winners. (TOP) They are, top row from left, Matthew Smiley of Brownsboro HS; Michael Silvey of Malakoff HS; Kaitlynn Kirkland and Jamila Murray of Athens HS. On the bottom row are their sponsors, Laurie Boze, Malakoff HS Counselor; Brandon Jones, Brownsboro HS Principal; and Thelma Griffin, Athens HS Counselor. Not shown is Mary Hamilton of Eustace HS. (BOTTOM) Along with our winners and their sponsors were some of their families to help celebrate this special occasion. Congratulations to our winners.

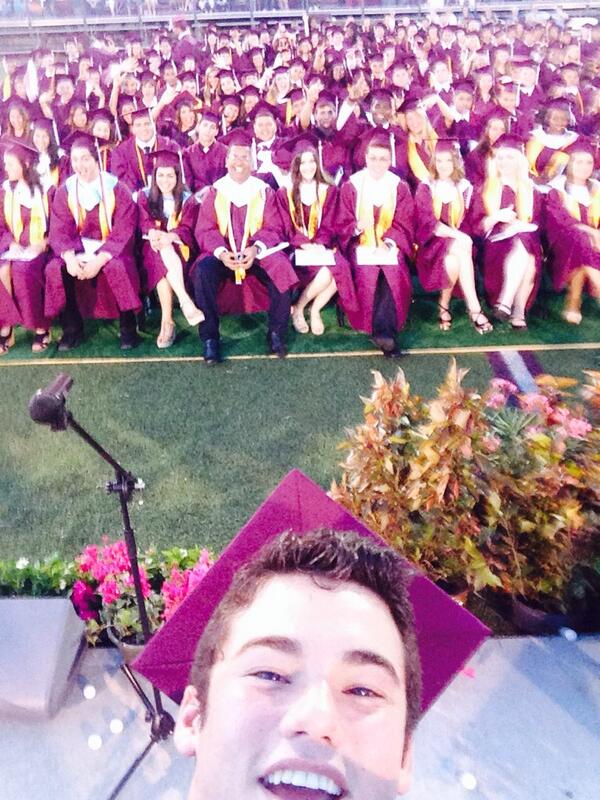

Ultimate Selfie: Athens High School graduation

#seniors2014 The ultimate selfie. Congratulations. pic.twitter.com/JY3R8cGp90

— Athens HIgh School (@AHS_Hornets) June 7, 2014