By Toni Garrard Clay/AISD Communications Specialist

By Toni Garrard Clay/AISD Communications Specialist

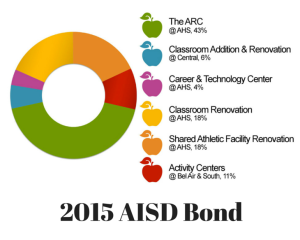

Since the board of trustees voted unanimously on Aug. 17 to call a $59.9 million bond election, some questions have been raised regarding the school district’s outstanding bond debt.

“Many people think of bonds the way they might think of getting a personal or business loan, when it fact they are not the same financial instruments,” explained Athens ISD Chief Financial Officer Randy Jones. “If a bond election is approved, the district is then able to begin the sale of bonds in $5,000 increments, which could be done all at once or over a period of years, depending on the projects, progress, payment schedule and market conditions.”

Jones noted the state of Texas only funds the operations portion of a school district’s budget, and districts have only one option to finance major renovation and construction: the sale of bonds. Therefore, he said, a school district with old buildings and/or a growing student population is by its nature going to have to turn to bonds to keep up with growth or structural improvements and additions.

“That’s why it’s particularly impressive,” said Jones, “that our board members and other leadership began saving as much as possible 10 years ago. As a result, we were able to accumulate $4.7 million — which included a $250,000 grant — to finance entirely out-of-pocket the projects now wrapping up at Central Athens and Athens High School. It’s the largest self-financed project this district has ever undertaken. Now, however, we’ve gotten as far as we can go without calling for a bond to finish the work that’s needed.” Central Athens has eight new classrooms and is finishing up connecting hallways between the gym and cafeteria and the main building. Athens High School is finishing construction on a new band hall.

The total principal outstanding on Athens ISD’s voted bond debt service is $15,045,000. The district’s tax rate currently rests in the bottom one-third of all ISD’s in Texas. The bond debt total comes from three separate bond series, one of which had no tax impact whatsoever.

Thanks to falling interest rates, Jones was recently able to refinance what remained of the 1999 $19 million bond issue, which financed the construction of Athens Middle School (now 15 years old). The original rates of 5 percent to 6 percent were renegotiated to the current range of 2 percent to 3 percent, which will save approximately $100,000 per year — a total of approximately half a million dollars over the remaining life of the bonds. The amount outstanding is $5.9 million. The final principal payment is due in August of 2020.

In 2009, voters approved $3.75 million worth of bonds which were used to remodel South Athens Elementary, renovate what is now Central Athens Elementary (previously Athens Intermediate), renovate Athens High School (primarily the Annex to accommodate the state-required Career and Technology Education program), provide upgrades to the track area at the high school, as well as other district improvements, including roofing, electrical and technology upgrades. The interest rate payable on the bonds sold range from 3 percent to 3.7 percent. The amount outstanding is approximately $2.6 million. The final principal payment due date is in August 2024.

In 2011, voters approved $6.5 million worth of bonds to expand and remodel Bel Air Elementary. These bonds are “Qualified School Construction Bonds,” which means the interest is subsidized by the federal government. Consequently, the sale of these bonds had zero impact on the school tax rate and taxpayers. The interest rate payable is 4.5 percent. Semi-annual interest only payments covered by the federal government will continue until maturity when the total principal is due. The final principal payment is due in August of 2025. The funds necessary to pay the principal will begin to be accumulated in 2020 in order to have ready the full amount by the maturity date. “The terms of the bond require the funds to be accumulated to meet the lump sum payment on Aug. 15, 2025,” said Jones.

((EDITOR’S NOTE: Read other coverage of the 2015 Athens ISD bond here.)